DROP AN ENQUIRY

Don't leave your loved ones in the dark. Protect your legacy with comprehensive estate planning. Secure your family's future with Capital Financial Services' expert Will and Trust Solutions.

Are you a resident of United States seeking a top-notch Online Estate Planning Service? Look no further. Our Robust Digital Estate Planning Solutions specialize in crafting tailored estate plans to safe guard your assets and fulfill your wishes.

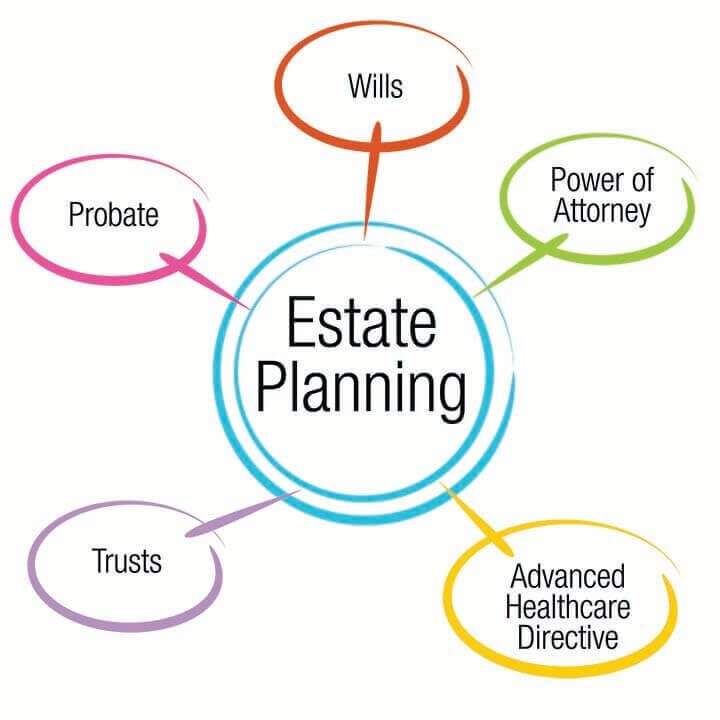

Our Online Estate Planning Service offer comprehensive services tailored to your needs. From wills and trusts to power of attorney, we help you secure your family's future.

At Capital Financial Services, we provide comprehensive estate planning solutions tailored to meet your needs. Our services ensure your assets are protected, your wishes are honored, and your loved ones are cared for. Explore our offerings below:

Essential Planning Package

Living Trust with Disclaimer Planning: Protect your assets with a living trust designed to include disclaimers that address potential future issues, ensuring your estate plan remains effective and flexible.

Pour-Over Will: This crucial document ensures that any assets not transferred to your trust during your lifetime will be poured over into your trust upon your death, securing your estate.

General Durable Power of Attorney: Designate someone to make financial decisions on your behalf if you become incapacitated, ensuring that your affairs are managed according to your wishes.

Advance Care Directive (Living Will): Outline your preferences for medical treatment and end-of-life care to guide your healthcare decisions when you're unable to communicate them.

Healthcare Surrogate Designation: Appoint a trusted individual to make healthcare decisions for you if you're unable to do so yourself, ensuring your medical care aligns with your preferences.

HIPAA Authorization: Grant permission for healthcare providers to share your medical information with designated individuals, ensuring your family or trusted contacts are informed about your health status.

Advanced Planning Package

Living Trust with A/B Planning: Implement a trust strategy that includes A/B planning, which can help minimize estate taxes and protect assets for your beneficiaries.

Irrevocable Life Insurance Trust: Establish a trust to hold your life insurance policy, ensuring that the death benefit is excluded from your estate and providing tax benefits.

Pour-Over Will: Similar to our Essential Planning Package, this will ensures any remaining assets are transferred to your trust upon your death.

General Durable Power of Attorney: As with the Essential Package, this document allows for the management of your financial affairs if you become incapacitated.

Advance Care Directive (Living Will): Clearly document your medical treatment preferences and end-of-life care instructions.

Healthcare Surrogate Designation: Appoint someone to make healthcare decisions on your behalf if needed.

HIPAA Authorization: Authorize the sharing of your medical information with chosen individuals.

A/B Planning for Living Trust: Incorporate advanced strategies to manage estate taxes and protect assets, providing long-term security for your beneficiaries.

Available Add-Ons

Deed Transfer Service: Facilitate the transfer of real estate property into your trust, ensuring it is managed according to your estate plan.

Additional Services for Clients with Unique Requirements

We offer tailored solutions to address specific needs or complex situations. Contact us to discuss how we can customize our services to fit your unique requirements.

Estate planning is a proactive approach to ensuring your assets are distributed according to your desires after you pass away. It's about providing peace of mind for yourself and your loved ones.

Lets understand in simple way. A person worked hard all his life. He built a home, raised a family, and saved for the future. Now, imagine how his loved ones will be after he is gone. Will they be okay? Will they know what to do? This is where estate planning comes in.

Estate planning is like a roadmap for everyone’s life journey. It’s a legal process that helps to decide what will happen to a person belongings like money, home, favorite possessions, etc when he is no longer around. It is like writing a love letter to his family, guiding them on how he wants things to be.

Protect your family's financial future: Safeguard your assets from potential disputes and unexpected taxes.

Minimize estate taxes: Implement strategies to reduce your tax burden.

Designate healthcare decisions: Ensure your medical wishes are honored through advance directives.

Appoint guardians for minor children: Provide for the care of your children in case of your incapacity.

Planning for the future is a sign of responsibility and love for your loved ones. Estate planning ensures that your hard-earned assets are protected and distributed according to your wishes.

Here's why estate planning is essential:

Peace of Mind: Knowing your affairs are in order allows you to focus on enjoying life without worry.

Protect Loved Ones: Safeguard your family's financial future by ensuring a smooth transition of assets.

Preserve Your Legacy: Honor your wishes and values by determining how your assets will be distributed.

Potential Tax Savings: Implement strategies to minimize estate taxes and maximize benefits for your heirs.

Avoid Family Disputes: Clearly outline your intentions to prevent misunderstandings and conflicts among loved ones.

By creating a comprehensive estate plan, you're taking proactive steps to secure your family's financial well-being and preserve your legacy for generations to come.

The cost of Estate Planning depends on the complexity of your situation. It can range from a few hundred dollars to thousands of dollars. But remember, the cost of not having a plan can be much higher. Capital Financial Services offers free consultations. This is a great way to understand more about your options and get a sense of how much it might cost.

Estate Planning for Different Life Stages

Estate Planning isn't just for older people. It's for everyone at every stage of life.

Young adults: You may not have much right now, but you can still start Planning for the future. A simple will can protect your loved ones.

Family: As you start a family, your Estate Planning needs grow. You'll want to think about things like guardianship for your kids and providing for your spouse.

Business owners: Business owners have special Estate Planning needs. You need to make sure your business is protected and your family is taken care of.

Elderly: As you get older, your Estate Planning becomes even more important. You need to make sure your wishes are clear and your assets are protected.

Estate Planning and Taxes

Taxes can eat up a large portion of your estate. An Estate Planning attorney can help you find ways to minimize estate taxes. There are different strategies, such as using a trust or making gifts, that can help you save money.

Estate Planning and Your Digital Legacy

In today's digital world, your online life is part of your legacy. Your social media accounts, emails, and online photos are all part of your digital footprint. You should think about what will happen to your digital belongings after you're gone.

So Don't Wait Anymore

Estate Planning may not be the most exciting topic, but it's one of the most important. Don't wait until it's too late. Take the time to protect your loved ones and your legacy.

In a Nutshell

Estate Planning is a gift of love. It shows your loved ones that you care about them and their future. It's a way to ensure that your wishes are followed and your legacy lives on.

So, what are you waiting for? Take the first step toward protecting your family's future. Start investing today.

Capital Financial Services is here to help you with all your Estate Planning needs. We offer a free consultation to discuss your goals and options. Call us today at +1 (913) 747-5547 or Whatsapp us at +19137475547.

Remember, peace of mind is priceless. Protect your legacy with a solid estate plan.

Quick Links

Don't let life's unexpected turns catch you off guard. Protect your loved ones and secure your legacy with a comprehensive estate plan.

Contact Capital Financial Services today for expert guidance.

Nagender Yadav, California

My parents came to visit from India and I was so worried about them. Thanks to Capital Financial Services, I was able to get them covered with great visitor insurance. It gave me such peace of mind knowing they were protected.

Praveen Kumar, Texas

I didn't think I needed life insurance, but after talking to Capital Financial Services, I realized how important it is for my family's future. Their plans are easy to understand and affordable.

Anuj Joshi, North Carolina

As I get older, I've been thinking about long-term care. Capital Financial Services helped me find a plan that fits my needs and budget. I'm so glad I took this step.

Amit Gupta, Indiana

A sudden accident left me unable to work. Thankfully, I had disability insurance from Capital Financial Services. It helped me cover my bills while I recovered.

Srikant, New York

Navigating Medicare can be confusing, but Capital Financial Services made it easy. They helped me choose the right plan and answered all my questions. I'm really happy with their service.

Chris, Illinois

Finding affordable health insurance can be a challenge. Capital Financial Services helped me find a plan that covers everything I need. Their team is really helpful and friendly.

About us

At Capital Financial Services, we guide you towards financial success with personalized wealth management, retirement planning, tax strategy, and investment advisory services.

Services

Useful Links

Contact

+1 (913) 747-5547

Mon - Sat 9:00 AM - 5:00 PM

Copyright © 2026 | Capital Financial Services (Trusted Finacial Advisor in United States)